-

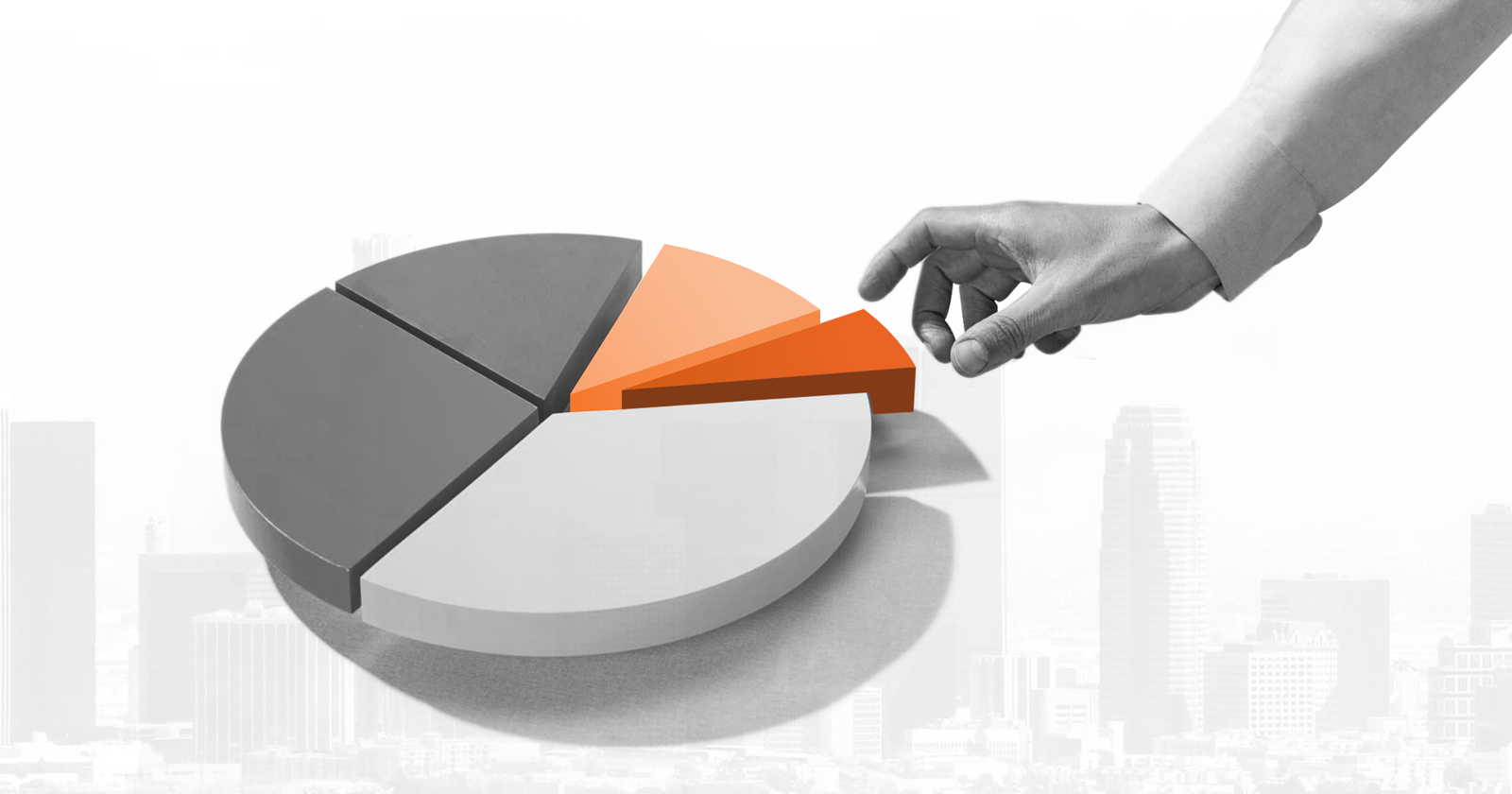

Introduction: Owning the Unownable

Imagine buying a slice of a ₹1 lakh share of MRF or owning a piece of a premium Bengaluru property worth ₹10 crores—without having to be rich. Sounds impossible? Welcome to the age of fractional investing, where financial power is no longer reserved for the elite.

As India transitions into a digital-first economy, a new wave of investing is emerging—fractional ownership of assets. It’s not just a buzzword anymore; it’s a movement. Whether it’s stocks, real estate, luxury items, or even art, Indians are now accessing investments in pieces rather than wholes.

Let’s dive deep into what fractional investing means, how it works, where it’s gaining traction, and how it’s changing the face of wealth-building in India.

-

What is Fractional Investing?

Fractional investing allows individuals to buy a portion of a high-value asset, rather than needing to purchase the whole. This concept has existed for years in developed countries, but in India, it’s now gaining momentum due to fintech innovation and regulatory support.

✅ Example:

Instead of buying 1 share of Tesla worth $1,000 (approx ₹83,000), you could buy 0.1 shares for just $100. Similarly, instead of owning an entire rental property, you could invest ₹25,000 and get fractional ownership with monthly rental income.

-

Why India Needs Fractional Investing

India’s population is young, aspirational, and tech-savvy—but not everyone has deep capital reserves. With skyrocketing real estate prices, blue-chip stock values, and inflation, traditional investing can feel out of reach for many.

🔸 MRF stock price over ₹1 lakh/share

🔸 Gold prices hitting ₹70,000/10g

🔸 Real estate becoming unaffordable in Tier-1 cities

🔸 Lack of diversification due to high asset entry costs

🧠 Solution?

Fractional investing breaks these barriers, offering accessibility, diversification, and ownership without the massive price tag.

-

How Fractional Investing Works

The process varies by asset class, but the core principle remains: pool capital from multiple investors to collectively own one asset.

🔸 An asset (stock, property, NFT, etc.) is listed on a platform

🔸 It’s divided into “fractions” or “units”

🔸 Investors buy these units based on how much they want to invest

🔸 They receive ownership rights, returns (if applicable), and appreciation benefits

-

Types of Fractional Investing in India

1. Fractional Stock Investing

Platforms like INDmoney, Groww, and Vested allow Indian investors to buy fractional shares of US-listed companies. You don’t need to buy a full share of Amazon, Tesla, or Google anymore.

🔸 Diversify across global markets

🔸 Invest small amounts (as low as $1)

🔸 Access to top-performing tech giants

🛑 Limitation:

Currently, fractional investing is limited to international stocks—not Indian-listed companies (due to SEBI guidelines)

2. Fractional Real Estate Investing

Companies like PropertyShare, Strata, and MYRE Capital let investors own a piece of commercial real estate—think tech parks, warehouses, or office spaces.

🔸 Minimum investment starting from ₹25,000–₹50,000

🔸 Monthly rental income

🔸 Capital appreciation

🔸 Legal ownership through SPVs (Special Purpose Vehicles)

🧠 Use Case:

Instead of buying a ₹1 crore property, 100 investors each put in ₹1 lakh to own and earn from it collectively.

🚫 Risks:

🔸 Low liquidity (long holding periods)

🔸 Dependent on property leasing and demand cycles

🔸 Exit often depends on platform-managed resale

3. Fractional Gold Investing

Platforms like SafeGold, MMTC-PAMP, and Paytm Gold offer digital gold in fractions, starting from ₹1.

🔸 24K gold linked to market price

🔸 Fully insured and stored in vaults

🔸 Option to convert to physical gold anytime

🔐 Safety:

All platforms are regulated, with gold stored with custodians like Brinks and insured for purity and theft.

4. Fractional Luxury and Collectibles

Startups like Assetmonk, RARIO, and Tykhe Block Ventures now offer fractional ownership in:

🔸 Rare watches (Rolex, Omega)

🔸 Blue-chip art (MF Husain paintings)

🔸 Sports memorabilia

🔸 NFTs and digital assets

💰 Reason?

These assets appreciate massively over time but are inaccessible to most. Fractional investing brings them to everyone.

-

Key Platforms Powering the Fractional Investing Revolution in India

| Platform | Asset Type | Minimum Investment | Key Feature |

|---|---|---|---|

| Vested | US Stocks | $1 (₹80 approx.) | Fractional share trading |

| Groww | US Stocks | $10 (₹800 approx.) | Beginner-friendly UI |

| PropertyShare | Commercial Real Estate | ₹50,000 | Grade-A assets, rental returns |

| Strata | Warehouses, Offices | ₹25,000 | Asset-backed SPV ownership |

| SafeGold | Digital Gold | ₹1 | Instant buy/sell |

| Assetmonk | Luxury, Real Estate | ₹10,000 | Fractional & rental combo |

| INDmoney | US Stocks + Gold | ₹100 onwards | Integrated portfolio tracking |

-

Pros of Fractional Investing

🔸 Accessibility – People can invest in high-value assets without waiting to save lakhs.

🔸 Diversification – You’re no longer putting all your eggs in one basket. Fractional models allow for spreading out across sectors and asset classes.

🔸 Passive Income – Real estate and gold often provide monthly rent or interest-like returns.

🔸 Democratization of Finance – Anyone with a smartphone and ₹100 can now build a diversified portfolio—a big win for financial inclusion.

-

Challenges & Limitations

🔸 Regulatory Ambiguity – India’s regulatory framework is still evolving around fractional ownership, especially for domestic stocks.

🔸 Liquidity Concerns – Real estate and collectibles may have long exit cycles. You can’t always sell immediately.

🔸 Platform Risk – What if the platform managing your asset shuts down or mismanages the asset?

🔸 Ownership Complexity – Legal rights may vary based on how ownership is structured (especially in real estate via SPVs).

-

The Future of Fractional Investing in India

Fractional investing is not just a trend—it’s a long-term structural shift in how Indians view money, assets, and investing. With the rise of:

🔸 Fintech platforms

🔸 Wealth-tech startups

🔸 Digital literacy

🔸 SEBI and RBI regulatory advancements

…it’s only a matter of time before fractional investing becomes a household concept, like SIPs did in the 2000s.

🧠 What to Expect:

🔸 SEBI regulations to allow fractional investing in Indian stocks

🔸 More REIT-style products for small-ticket property investors

🔸 Tokenized asset ownership using blockchain

🔸 AI-driven advisory for fractional portfolios

-

Who Should Consider Fractional Investing?

✅ Ideal For:

🔸 Young investors with limited capital

🔸 Salaried professionals looking to diversify

🔸 People wanting exposure to real estate without loans

🔸 Investors seeking passive income from stable assets

🚫 Not Ideal For:

🔸 People needing short-term liquidity

🔸 Investors without understanding of the asset risks

🔸 Those seeking guaranteed returns

-

Conclusion: Breaking the Monopoly of Wealth

Fractional investing is India’s answer to the age-old problem of wealth concentration. It offers a fair shot at financial growth to every aspiring investor—whether they have ₹500 or ₹5 lakhs. By lowering the entry barriers and improving access, fractional investing is reshaping how the nation builds wealth—one fraction at a time.

In a world where opportunities often come with high price tags, fractional investing is India’s democratizing force, making wealth-building not just a dream—but a very achievable reality.