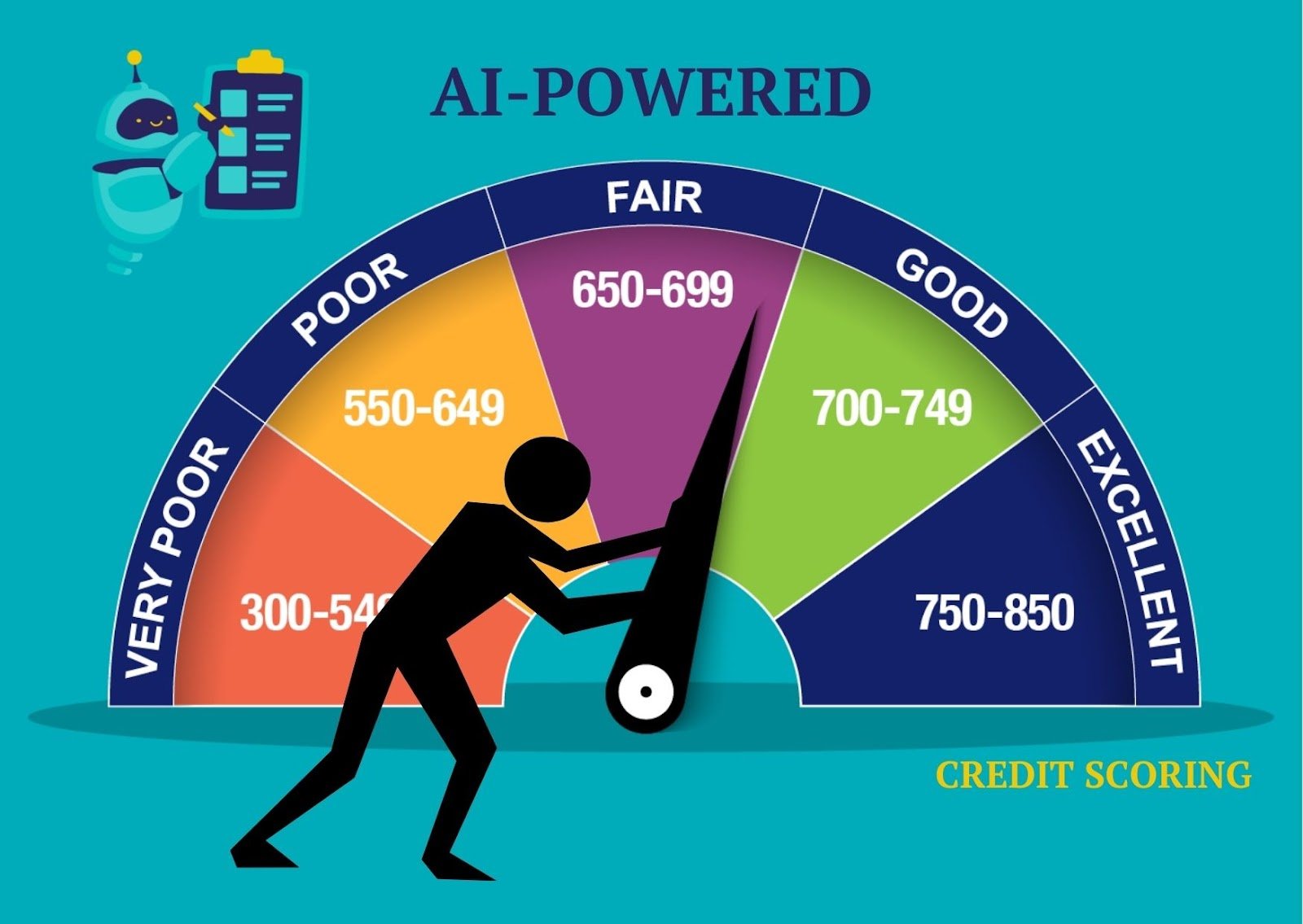

In an era defined by data, algorithms, and automation, credit scoring is no longer the exclusive domain of human judgment and Excel sheets. The rise of artificial intelligence (AI) in financial decision-making is pushing traditional credit scoring methods to the sidelines. The question is: can AI truly judge risk better than humans—or are we just building more sophisticated black boxes?

Let’s unpack this multi-billion dollar evolution of how we decide who gets credit—and who doesn’t.

-

The Traditional Credit Scoring Landscape: A Quick Primer

Before we plunge into AI, let’s rewind. Credit scoring has traditionally relied on models like FICO (in the U.S.) and CIBIL (in India), which calculate creditworthiness based on a few static variables:

🔸 Repayment history

🔸 Credit utilization ratio

🔸 Length of credit history

🔸 Types of credit used

🔸 Recent credit inquiries

These rule-based models are straightforward, interpretable, and standardized—but they also have blind spots. They don’t factor in nuanced behavior, cash flow patterns, or alternative data like digital footprints, utility payments, or mobile usage—especially critical in countries like India where many borrowers are ‘thin-file’ or new-to-credit.

-

Rise of AI in Credit Scoring: The 2025 Snapshot

In 2025, AI-based credit scoring is fast becoming the norm, especially in India’s digital lending and fintech ecosystems. Here’s why:

🔸 Machine learning models thrive on data volume and variety—AI can process thousands of variables including payment patterns, GPS data, app usage, SMS parsing, and even social media behavior.

🔸 Faster decision-making—Loan approvals that once took days now take minutes.

🔸 Reduced operational costs—Lenders no longer need armies of underwriters and analysts.

🔸 Deeper penetration—AI can score those who were once unscoreable, enabling financial inclusion.

Key players like CredAvenue, KreditBee, CASHe, and LazyPay are all deploying AI-driven models that bypass traditional bureau scores. Even banks like HDFC and ICICI are integrating ML-based systems for faster risk evaluation.

-

How AI Models Work: Beyond Linear Thinking

AI credit models don’t work like spreadsheets. They analyze non-linear relationships, patterns, and correlations among thousands of data points. Some key technologies used include:

🔸 Neural networks – mimic human brain architecture to detect complex patterns.

🔸 Random forests – use decision trees to make smarter, ensemble predictions.

🔸 Natural Language Processing (NLP) – analyze communication tone in applications or SMS history.

🔸 Reinforcement learning – models learn from their own predictions and outcomes over time.

Imagine this: instead of just knowing you paid your EMIs on time, an AI model knows you always repay 2 days before the due date, shop online on the 15th every month, and never miss a utility bill. That behavioral granularity is powerful.

-

Pros: Why AI Might Be Better Than Humans

AI isn’t just faster—it may actually be smarter. Here’s why it might outperform traditional systems:

🔸 Contextual understanding – AI can detect early distress signs like changes in spending behavior.

🔸 Real-time adaptability – Models update based on real-time data, not quarterly reports.

🔸 Bias reduction – When trained right, AI can reduce human biases based on gender, location, or caste.

🔸 Scalability – AI can handle millions of applications per day without fatigue.

AI is especially transformative for gig workers, freelancers, and small business owners who traditionally struggle to get loans due to inconsistent incomes.

-

The Big Risks: Bias, Black Boxes, and Bad Data

It’s not all sunshine. AI comes with serious baggage:

🔸 Bias is baked in – If your training data reflects societal biases (like women getting fewer loans), AI will perpetuate them.

🔸 Lack of explainability – Why did the model reject a loan? Good luck getting a straight answer.

🔸 Privacy issues – The hunt for data can cross ethical lines—like analyzing personal photos, DMs, or call logs.

🔸 Data quality matters – Garbage in, garbage out. Bad data leads to bad decisions.

Many regulators including the RBI are grappling with how to regulate these black-box systems without stifling innovation. Explainable AI (XAI) and human-in-the-loop (HITL) models are being pushed to balance automation with accountability.

-

The RBI’s Stance: Regulation vs Innovation

India’s central bank isn’t turning a blind eye. The RBI in 2024 released draft guidelines for digital lenders and AI-powered credit scoring, mandating:

🔸 Explainability of decisions

🔸 Audit trails for model changes

🔸 Explicit customer consent for data usage

🔸 Bans on scraping sensitive personal content without permission

The RBI is trying to build a ‘trust tech’ layer on top of AI—where the models aren’t just powerful, but also fair, ethical, and accountable.

-

What This Means for Consumers: Prospects and Pitfalls

If you’re a borrower in 2025, AI credit scoring can either be a blessing or a curse:

🔸 Faster approvals – Get instant loans based on mobile behavior.

🔸 Wider access – New-to-credit users finally have a shot at borrowing.

🔸 Greater customization – Loans tailored to your cash flow and risk.

But on the flip side:

🔸 Opaque decisions – You may never know why you were denied credit.

🔸 Data misuse – Your digital life is constantly being surveilled.

🔸 Digital divide – Those without enough digital activity get excluded.

Being mindful of what you share, where you spend, and how you behave online is now directly tied to your financial future.

-

What’s Next? The Future of Credit Scoring

Here’s where things are headed:

🔸 Hybrid scoring systems – Combining AI insights with traditional bureau scores.

🔸 Greater personalization – Scoring models that adapt to your goals (home loan vs business loan).

🔸 RegTech revolution – Real-time regulatory tech to oversee AI models.

🔸 AI-generated credit reports – Auto-written, consumer-friendly credit explanations.

🔸 Open finance integration – Access to GST, bank account, mutual fund, and UPI data under OCEN framework.

India’s fintech ecosystem—especially neobanks and embedded lenders—is aggressively exploring these innovations to boost both inclusion and profitability.

-

Final Verdict: Human vs AI — Who Wins?

AI isn’t here to completely replace human credit analysts. It’s here to augment them. The best results come from collaboration:

🔸 Let AI find patterns no human can see.

🔸 Let humans challenge and audit decisions AI can’t explain.

🔸 Let regulators ensure transparency, fairness, and accountability.

In a perfect world, AI-driven credit scoring isn’t about replacing humans. It’s about making risk more visible, lending more inclusive, and finance more intelligent.

And for borrowers? It’s about time your digital behavior mattered more than just your CIBIL score.